Explore Our Courses

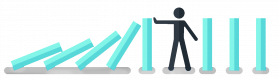

Planning and Risk Assessment

14 HoursFixed Assets Management and Control

14 HoursProject Risk Management

7 HoursLast Updated:

Testimonials(2)

workshops, open discussion

Renata Ostrowska - BFF Polska S.A.

Course - Planning and Risk Assessment

Hakan was very enthusiastic and knowledgeable

Hugo Perez - DENS Solutions

Course - Project Risk Management

Upcoming Courses

Other Countries

These courses are also available in other countries

Online Risk Management courses, Weekend Risk Management courses, Evening Risk Management training, Risk Management boot camp, Risk Management instructor-led, Weekend Risk Management training, Evening Risk Management courses, Risk Management coaching, Risk Management instructor, Risk Management trainer, Risk Management training courses, Risk Management classes, Risk Management on-site, Risk Management private courses, Risk Management one on one training